If you’re running Google Ads for your business, you might have wondered, “Do I need to pay VAT on this?” It’s a common question, and honestly, the answer isn’t always straightforward. VAT rules can be confusing, especially when it comes to digital services like advertising.

The thing is, not knowing whether VAT applies could cost you. You might end up paying more than necessary or, worse, run into trouble with tax authorities. But here’s the good news: handling VAT for Google Ads isn’t as tricky as it seems once you understand the basics.

In this blog, we’ll break it all down—whether VAT applies, how to handle it if you’re in the UK (or elsewhere), and the common mistakes to avoid. Let’s get you on the right track so you can focus on what matters most—growing your business!

What is VAT?

Value Added Tax (VAT) is a tax charged on goods and services. VAT amounts differ depending on what country you’re in. The standard VAT rate in the UK is 20%.

There are also reduced rates for specific goods and services:

- 5%: Applied to items like domestic energy and children’s car seats.

- 0% (Zero-rated): Covers items such as most food, children’s clothing, and books.

Does VAT Apply to Google Ads?

VAT is charged on digital services like advertising. Since Google Ads is a digital advertising platform, VAT often comes into play, but how it’s handled depends on where your business is located and whether you’re VAT-registered.

If your business operates in a country where VAT is applicable, you’ll likely need to account for it when using Google Ads.

For example, in the UK and the European Union, Google doesn’t automatically charge VAT to businesses if they provide a valid VAT ID. Instead, the responsibility falls on the business under the “reverse charge mechanism.” This means you must account for the VAT on your tax return, even if Google doesn’t add it to your invoices.

For businesses that aren’t VAT-registered, Google typically charges VAT on top of your ad spend, which will show up on your invoices. The exact rules can vary by country, so it’s essential to understand your local VAT regulations to ensure compliance.

For example, as of April 1, 2022, Google charges 7.5% VAT for all Google Ads customers with a billing address in Nigeria to comply with local legislation. Similarly, from February 1, 2023, Google began charging 16% VAT for customers in Kenya due to changes in local tax legislation

What is DST, and How Does It Compare to VAT?

DST (Digital Services Tax) is a tax levied on revenue large digital companies generate from providing digital services, such as online advertising. It’s designed to ensure that these companies contribute to public finances in the countries where they operate, especially when they have a significant digital presence.

The key difference is that VAT is typically charged to end consumers and collected by businesses, while DST targets the revenues of digital service providers like Google.

| Aspect | VAT | DST |

|---|---|---|

| Target | Consumers of goods/services | Digital service providers |

| Basis | Consumption (tax on sales/purchases) | Revenue earned by digital companies |

| Who Pays? | Customers, collected by businesses | Companies, passed on to advertisers |

| Rate (UK) | 20% | 2% |

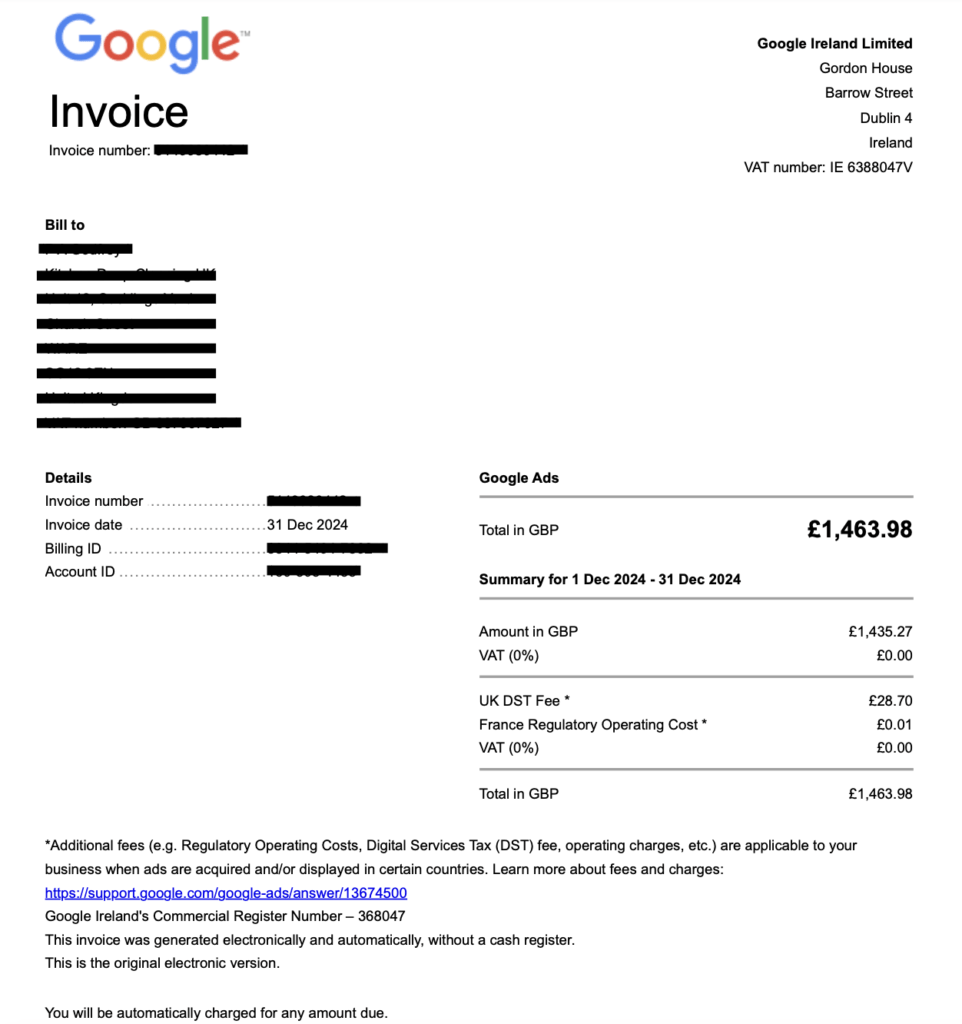

On November 1, 2020, Google introduced a 2% UK Digital Services Tax (DST) Fee on invoices for ads served in the United Kingdom. This fee is not the same as VAT.

- What It Covers: The DST fee applies to the revenue Google earns from ad services delivered in the UK. It’s essentially a cost passed on to advertisers.

- Where It Appears: You’ll see the DST fee itemised separately on your Google Ads invoices or statements.

How to Handle VAT for Google Ads

Handling VAT for Google Ads doesn’t have to be a headache—it’s all about knowing what steps to take based on your VAT registration status. Let’s break it down:

1. Register for VAT

If your business meets the VAT threshold (or you choose to register voluntarily), the first step is to register with your local tax authority. In the UK, you can do this through the HMRC website. Once you’re registered, you’ll receive a VAT number that you’ll need for your tax returns and Google Ads account.

2. Steps for VAT-Registered Businesses

When setting up your Google Ads account, you’ll need to choose your account type, purpose of use, and tax status. These choices are permanent, so pick carefully as they’ll affect your VAT reporting and could be used for identity verification.

Account Type

- Organisation: For businesses, institutions, or partnerships, or if you’re a sole proprietor using a trade name.

- Individual: For personal use under your own name. Note, you won’t be able to change user permissions or add/remove users with this option.

Purpose of Use

- Business: If you’re using Google Ads for commercial gain, like increasing sales or revenue.

- Eligible non-business: For political, charitable, or non-profit activities.

Your tax treatment depends on the purpose of use you select. The tax ID you provide will be linked to your account type—whether for an organization or individual. If you sign up for other Google services, your tax status might also affect how they handle VAT.

- Add your VAT ID to Google Ads: Log in to your Google Ads account, go to “Billing Settings,” and add your VAT ID. This ensures Google won’t charge VAT on your invoices.

- Use the reverse charge system: Google applies the reverse charge for businesses in many countries, including the UK. This means you’re responsible for accounting for VAT on your Google Ads spend in your VAT return. Essentially, you’ll declare the VAT on your purchase but can usually reclaim it simultaneously if it’s a valid business expense.

- Review invoices regularly: Check your Google Ads invoices to ensure the reverse charge is correctly applied. Save these invoices as they’re essential for your VAT records.

3. What Happens If You’re Not VAT-Registered?

If you’re not VAT-registered, Google will automatically add VAT to your advertising costs, just like with any other service. This means your invoices will show the VAT as a separate line item. Unfortunately, since you’re not VAT-registered, you won’t be able to reclaim this amount.

4. Downloading Your VAT Invoice

Your VAT invoice for a given month is available from the 5th business day of the next month. For example, September’s invoice will be ready by October 5. Invoices are not generated on weekends or holidays, so there might be delays during those times.

If you’re using manual payments, you’ll get two invoices—one at the time of prepayment, and another at the end of the month. For automatic payments, you’ll receive one invoice at the end of the month, with no sections on costs or payments received.

To find and download your VAT invoice:

- In your Google Ads account, click the Billing icon.

- Select Documents.

- Tick the box next to the invoices you want to download.

- To select all invoices, check the box at the top left of the table.

- Click the Download selected button at the top right.

- Choose your preferred format.

- Click Download, and your invoices will automatically save to your computer for viewing or printing.

5. Filing VAT Returns

For VAT-registered businesses, you’ll need to include your Google Ads spending in your VAT returns.

- Declare the VAT under the reverse charge mechanism (usually in Box 1 and Box 4 of your UK VAT return).

- Report the total spend (excluding VAT) in Box 7.

If you’re unsure, your accountant or tax advisor can help ensure everything is correctly recorded.

VAT’s All, Folks!

Dealing with VAT on Google Ads might seem a bit confusing at first, but it’s pretty straightforward once you’ve got the basics down. Whether you’re VAT-registered or not, the key is understanding how it applies to your UK business and making sure your invoices and returns are in order.

Remember to add your VAT ID to your Google Ads account if you’re registered, and keep an eye on those invoices for the reverse charge. If you’re not VAT-registered, just factor the added 20% into your advertising budget.

By staying on top of your VAT obligations, you can focus on what really matters—running those campaigns and driving results for your business!